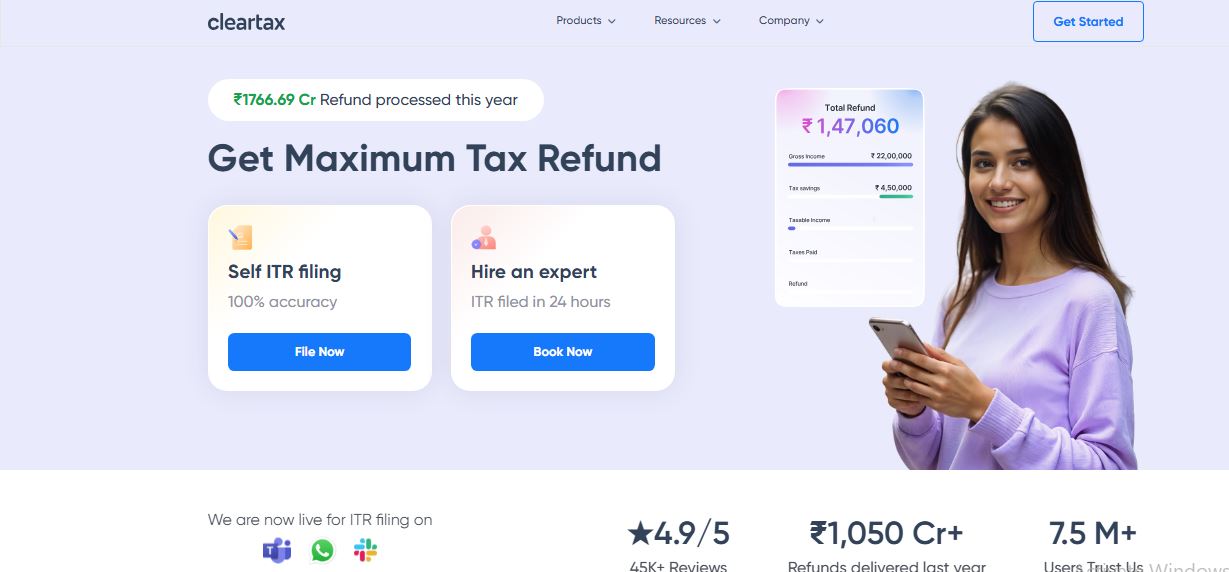

Cleartax: Your Ultimate 2025 Guide to Stress Free Tax Filing Tax season in India used to mean mountains of paperwork and expensive consultations. Today, ClearTax has transformed this experience into a simple, digital process. Whether you are a salaried employee, a freelancer, or a business owner, ClearTax provides a smart, AI-driven interface to manage your finances with 100% accuracy

Contents